A superb primer on cryptocurrency

This week’s flagship article is a brilliant email by the peerless Matt Levine on the Ethereum Merge.

📄 Article/s of the week

a. Ethereum is Merging by Matt Levine

(Note: The article is paywalled – you can, however, get it for free by subscribing to the newsletter. If you cannot access it online, you can read a PDF copy of the email here – all rights belong to Matt!)

One piece of news is dominating the world of crypto – the “Ethereum Merge“.

I do not even want to try to explain what that means because: (1) I have no clue and (2) We have Matt Levine for precisely that reason.

Let’s begin with the rationale and operating model for cryptocurrency itself. In a recent edition of his newsletter, Matt crafted perhaps the simplest explanation I’ve read about blockchain/bitcoin. Read these four opening paras:

The idea of a blockchain is that you want to do bank transfers without a bank. You want people to be able to do transactions, and have them confirmed, and have there be some canonical agreed list of the transactions, but you don’t want to trust some central party to do it.

At a high level, the blockchain solution is to confirm transactions by letting everyone keep a copy of the transaction ledger. And then the official ledger is based on consensus among people who have some demonstrated stake in the system. What that has often meant in practice — what it means in Bitcoin and what it originally meant in Ethereum — is “proof of work.” What you do is, you buy a bunch of computers, and you set them to work solving meaningless math problems, and whoever solves the most math problems the fastest gets to confirm a block of Bitcoin transactions, and they are rewarded with some newly minted Bitcoins and then everyone starts over solving more math problems to confirm more transactions. Buying the computers, and paying for the electricity to run them to solve the math problems, demonstrates your commitment to Bitcoin: It would be crazy to spend all that money on computers and electricity to confirm fake transactions, which would undermine the value of Bitcoin and thus of your investment.

This is called “mining”: You spend money on computers and electricity, and then you are rewarded with newly created Bitcoins. And there are people, and publicly traded companies, who are in the business of Bitcoin mining and thus of maintaining the Bitcoin network. The inputs are electricity and the outputs are Bitcoin.

This was a clever innovation and has some important benefits. It lets you have a ledger that is maintained by people with incentives to do the right thing — people you can trust — without knowing who they are. There is no pre-approved list of people who are allowed to maintain the Bitcoin ledger; anyone who buys enough computers and electricity can participate. It is permissionless. But because they have to buy all those computers and electricity, they have good incentives to maintain the ledger in a good way.

I loved that part about solving “meaningless math problems”… (although the word meaningless is redundant ;p).

Matt then continues with highlighting the biggest issue with mining – its energy-intensive nature:

But there are some problems. The biggest is that it uses a ton of electricity solving pointless math problems, which seems wasteful both in environmental terms (you’re emitting a lot of carbon to generate all that electricity) and also in economic terms (the Bitcoin system is effectively paying utility companies a lot of money to maintain its ledger).

The solution? Move from a “proof of work” to a “proof of stake” model:

Developers of later blockchains realized that, if the point here is to have transactions confirmed by people with a demonstrated stake in the system, there are easier ways to demonstrate a stake in the system. Most simply: If you have a lot of Bitcoins, you will want Bitcoin to be valuable, and so you will want to confirm transactions honestly in order to keep Bitcoin valuable. Instead of proving that you have an economic stake in the system by spending a lot of money on computers and electricity, you could prove that you have an economic stake in the system by spending a lot of money on Bitcoin. If you have a lot of Bitcoin, that proves that you care about Bitcoin, so you get to participate in confirming transactions.

Well, that is not how Bitcoin works, but it is how Ethereum works starting, uh, today-ish.

He then parses it a bit further and comes to the realisation that this is like nothing but… interest on a savings account:

The economic model here is a bit different from the Bitcoin proof-of-work model. In that model, professional miners basically buy electricity and turn it into Bitcoins. In this model, professional stakers, or their customers, basically buy Ether and turn it into more Ether. You take your Ether, you lock it up in an account at a financial services firm for a while, and your Ether grows by some steady percentage. You know: like interest.

Read his entire piece to get the detailed yet nuanced perspective. In my book, there are no other writers who can make high-finance so simple yet entertaining to read.

b. 6 Mental Models for Solving Problems by Ali Abdaal

In this short but insightful post from his newsletter, prominent YouTuber and course creator Ali Abdaal gives us a good selection of questions to ask when we are stuck at something.

The 6 questions:

🎯 1. What Core Value Are You Optimising For?

💁 2. What Would Your Mental Board of Advisors Say?

💀 3. What Are Your Underlying Assumptions?

🐌 4. Can You Adjust the Friction?

🦾 5. Are You Applying Leverage?

🧪 6. Are You Giving Yourself Permission to Experiment?

I especially liked the one about assumptions – often when we seem to be stuck on a decision, we have underlying assumptions that we don’t question. For e.g.

– I can’t decide what film to watch tonight… → Who says I have to watch a film? Why not go for a walk instead?

– I need to rush this YouTube video for the sponsorship deadline. → Do I? No one will pull the plug on a sponsorship just because the video came out a day or two late. I should relax, and focus on making a good video.

I like Ali’s newsletter – consider giving it a subscribe.

🎧 Podcast episode/s of the week

a. Interview with Kabeer Biswas (CEO, Dunzo) on First Principles by The Ken

CEO interviews on podcasts – especially candid ones – are rare in India. Which is why this new podcast hosted by Rohin Dharmakumar (cofounder of The Ken) looks really promising.

I heard their first episode with Kabeer Biswas of Dunzo. It has some eye-opening revelations:

– Kabeer personally has done around 10,000 tasks!

– While most hyperlocal delivery companies focus on speed (10 min delivery!), Dunzo realised that in India speed is not the most important factor for customers. Price and selection are also key. So instead of ‘quick commerce’, Kabeer calls it ‘Quick enough’ commerce!

– Speaking about reviews and metrics, Kabeer made an interesting point: At Dunzo, conversations are not about running through a whole bunch of metrics… They spend a lot of time on understanding which metrics are really important. They try and reduce the number of things to be tracked and focus on what they call as P0 (Priority 0) metrics.

– At Dunzo, Kabeer is known for one phrase – “Mota Mota” (roughly). Getting perfect answers is not always important!

– Kabeer is big on reading and came to a realisation some time back: He was not buying all the books he wanted, because he was worried that he was not getting time to read them. So he disconnected the act of buying books from reading them. Now he buys a lot of books irrespective of whether he would manage to read them or not. He revealed that he manages to read only one in 10 of the books he buys!

The podcast is a fascinating portrait of an India-first product company and a young homegrown leader.

🐦 Tweet/s of the week

This thread live-tweeted from a restaurant (most likely in Mumbai) features some great storytelling. Vivid, funny and entertaining!

Btw, I’ve been to a few “uncle bars” in Mumbai myself. Suyog in Wadala recommended by (who else) my uncle is a favourite haunt for us. I find these restaurants fabulous – chilled beer, free chakna (snacks), super quick service, no loud music (which enables great conversations) and reliable, no-nonsense food.

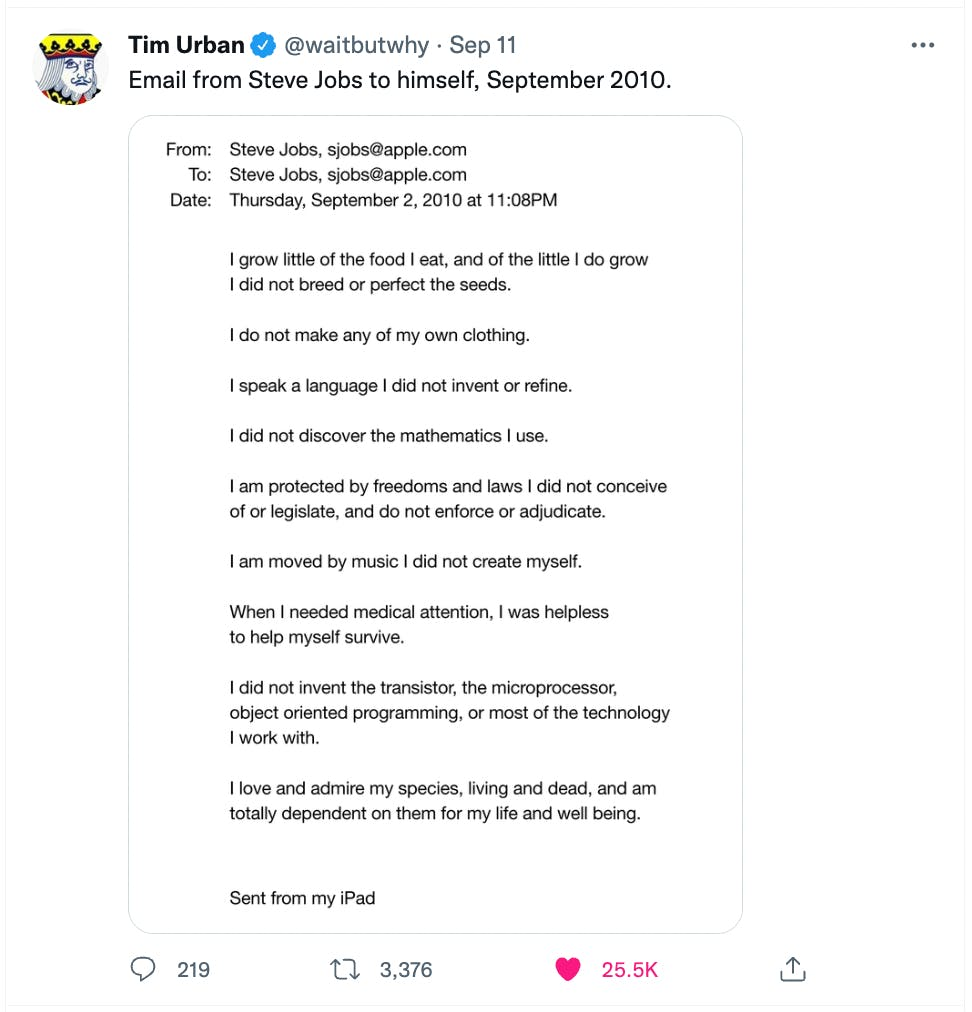

Gratitude can be powerful.

A great collection of non-fiction book recommendations for the history of key industries.

💬 Quote of the week

“Whereas most technologies tend to automate workers on the periphery doing menial tasks, blockchains automate away the center. Instead of putting the taxi driver out of a job, blockchain puts Uber out of a job and lets the taxi drivers work with the customer directly.”

– Vitalik Buterin, founder Ethereum

📺 Video of the week

I had two days of training scheduled in Bangalore last week (and two in Hyderabad with the same company). It got postponed because of the threat of rains in Bangalore.

I’ve grown up in Mumbai and suffice to say that I have seen my fair share of heavy rains. If they started shutting Mumbai down for such episodes, the city would never work during the monsoons.

There is something off with Bangalore. For a city with so much resources to struggle so badly with basic civic services is an epic, tragic fail.

At least this illuminating video by Shekhar Gupta gave me some sense of the political realities that underpin this shoddy situation.

For the sake its residents (some of the nicest people) and for the sake of India’s reputation, I hope that better sense prevails and we see some improvement in the future.

That’s it folks: my recommended reads, listens and views for the week.

Take care and stay safe.