Damodaran’s storytelling on valuation

Welcome to the fiftieth edition of ‘3-2-1 by Story Rules‘. (Hooray, a half-century!)

A newsletter recommending good examples of storytelling across:

- 3 tweets

- 2 articles, and

- 1 long-form content piece

Let’s dive in.

🐦 3 Tweets of the week

Hard deadlines are the answer? Need to have some commitment devices!

Hahaha, can’t attribute causality without control.

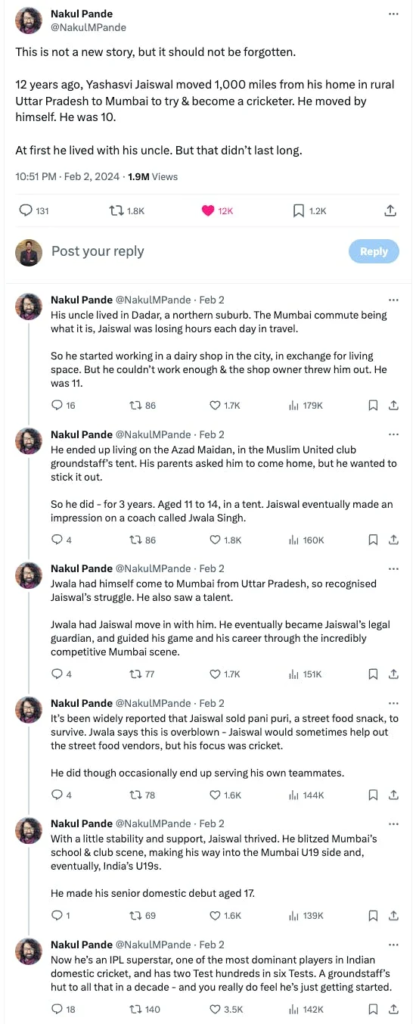

I usually don’t share threads, but Yashaswi’s story is so inspiring – and well written!

📄 2 Articles of the week

a. ‘Is the west talking itself into decline?’ by John Burn-Murdoch (Financial Times)

Fabulous FT storyteller John Burn-Murdoch published an intriguing piece (Jan-2024) on the importance of popular culture as a factor driving growth and decline in economies.

The article starts with by mentioning some of the widely known factors that drove the Industrial Revolution in Britain: the high wages and low energy prices prompting investment in mechanisation, the presence of strong institutions, and the mixing of diverse peoples.

But one idea was intriguing:

Another interesting theory is that of economic historian Joel Mokyr, who argues in his 2016 book ‘A Culture of Growth’ that it was broader cultural change that laid the groundwork for the industrial revolution.

That idea has been recently tested by economists, due to the availability of better tools:

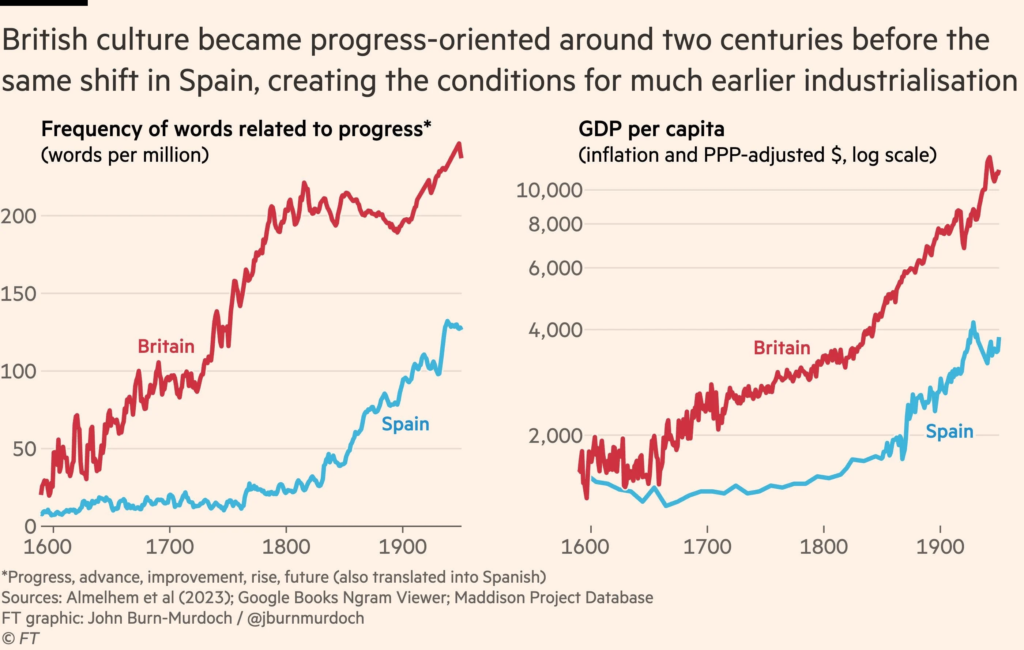

… a fascinating paper published last month by a quartet of economists puts some evidence behind the argument. The researchers analysed the contents of 173,031 books printed in England between 1500 and 1900, tracking how the frequency of different terms changed over time, which they use as a proxy for the cultural themes of the day.

They found a marked increase in the use of terms related to progress and innovation starting in the early 17th century. This supports the idea that “a cultural evolution in the attitudes towards the potential of science accounts in some part for the British industrial revolution and its economic take-off”.

This increase in use of progress-related terms was higher in Britain compared to Spain – which correlates with an earlier and higher increase in per capita income in Britain:

The most interesting implication: John ran the same analysis on present-day books and articles

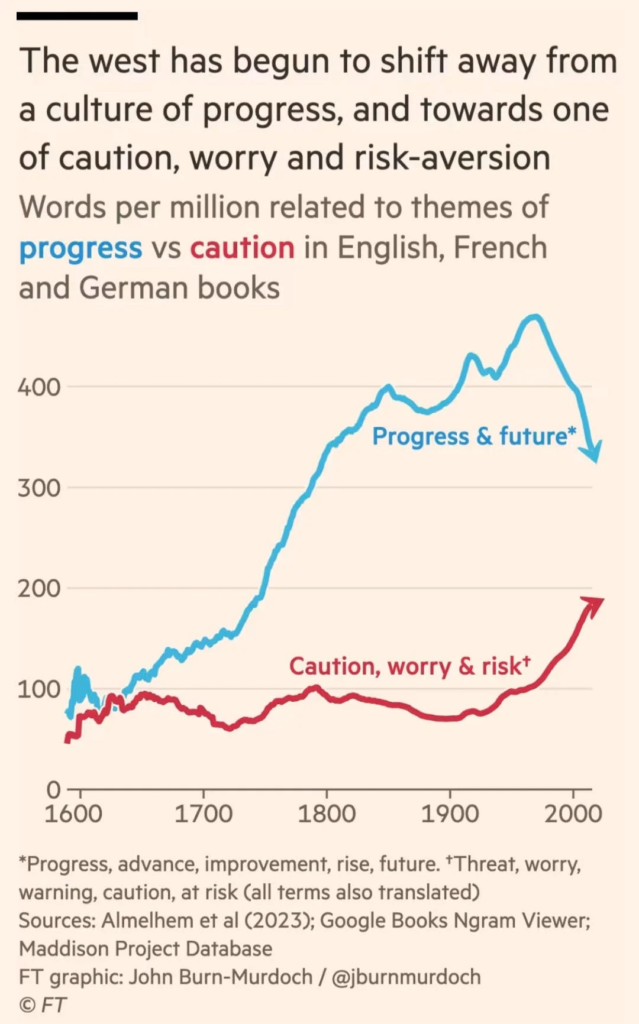

Extending the same analysis to the present, a striking picture emerges: over the past 60 years the west has begun to shift away from the culture of progress, and towards one of caution, worry and risk-aversion, with economic growth slowing over the same period. The frequency of terms related to progress, improvement and the future has dropped by about 25 per cent since the 1960s, while those related to threats, risks and worries have become several times more common.

This graph is striking:

For more, check out John’s fascinating Twitter thread on the topic.

b. ‘The stithapragya framework for personal branding’ by Karthik Srinivasan

Advertising and personal branding expert Karthik Srinivasan makes a compelling case for not letting the ‘moh-maya’ of likes and shares affect your content-sharing efforts.

I could not agree more, especially with the first sentence below:

When you frame content as something you gain yourself first, then there is no so-called ‘wasted’ content. There is no piece of content where the supposedly low Likes, Comments, or engagement would bother you. You had a point to make/a view to share, and you did. Every piece of content you share adheres to a larger plan which, in turn, is based on your personal brand definition. From this vantage point, there are no good or bad days at all!

In a way, the best way to understand this is to consider the word (in Tamil) – Stithapragya. The word is used in a worldly, philosophical sense in the Bhagavad Gita, meaning “a state of mind where loss or gains do not affect an individual”. But within the context of personal branding, it would be the state of mind that remains unaffected by everyday content’s performance because the mind is steadily focused on the long term… on the larger picture!

🎧 1 long-form listen of the week

a. ‘Introduction to Valuation’ by Ashwath Damodaran (video)

Education sector leader and good friend Anustup Nayak tagged me on Twitter in a post that raved about this 2014 video by valuation expert Ashwath Damodaran.

Ashwath’s video is not just a great intro on valuation, it is also a wonderful example of storytelling.

My top 3 highlights:

1. The use of the Rule of 3: Ashwath covers 3 broad themes in valuation, 3 types of investors, 3 obstacles and 3 approaches!

2. The arresting analogy of lemmings to describe types of herd-behaviour of investors:

…you probably heard about lemmings right? They became famous or infamous about 5 years ago when National Geographic for the most amazing sight thousands of big ugly rat-like creatures – that’s what lemmings look like – gathered together on a cliff ran right off the cliff into an ocean and ever since the big questions has been why do they do it? Why do they go off that cliff? Why do they commit collective suicide? I don’t know the answer to the question but let’s do some collective imagery.

You can see why the first lemming did it right? Was going too fast, he couldn’t stop, he went right off the cliff into an ocean. What about the second guy? He’s going too close to the first guy same thing. But put yourself in the shoes of the very last lemming in that group. You’re going as fast as you can towards a cliff. You’ve seen an entire tribe disappear off that cliff. I would assume you’re having second thoughts about what you were planning to do. Your right brain, left brain, whatever part of you is rational, is saying stop, don’t do it. But then you’re (hearing) this voice in the back of your head. You know what? They must know something that you don’t. Remember those seven words. They’re the seven most deadly words in investing”

3. The use of pithy statements that convey a lot (emphasis mine):

… one of the great ironies in valuation is the more uncomfortable you feel valuing a company the greater the payoff to doing a valuation

… the third misconception about valuation (is) if you make a model bigger it’s going to get better and it’s so easy to build big models now. As you build these big models in Excel or whatever your tool of choice is, remember you have to make those assumptions those inputs that drive these models and as these models get really complex two things happen. One is these models become black boxes. After a while it’s not clear who’s running whom – are you running the model or is the model running you?

That’s all from this week’s edition.

Photo by Josh Appel on Unsplash