End of the era of Trust?

Welcome to the seventh edition of ‘3-2-1 by Story Rules‘.

A newsletter recommending good examples of storytelling across:

• 3 tweets

• 2 articles, and

• 1 long-form content piece

Each would be accompanied by my short summary/take and sometimes with an insightful extract.

Let’s dive in.

🐦 3 Tweets of the week

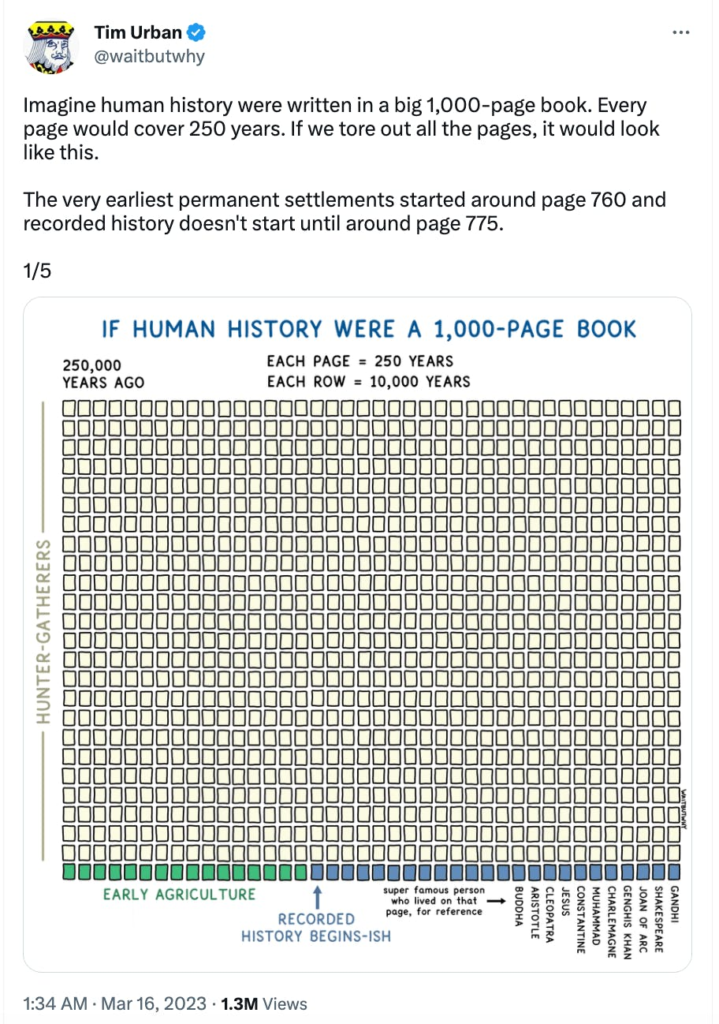

Tim Urban is the master at showing perspective – such a simple yet powerful way to make us realise how long the hunter-gatherer era lasted.

Found this gem in Matt Levine’s newsletter – small banks don’t have a great prognosis.

Chris Bakke doing what he does best – puncturing self-proclaimed experts who emerge out of the woodwork once some big news event happens.

📄 2 Articles of the week

a. ‘The new layoff communication trend by CEOs: “I take responsibility”’ by Karthik Srinivasan

Advertising maven Karthik does a great job of collating layoff-apology letters written by CEOs and finding the common truth – most people take responsibility but don’t really do anything concrete about it… Except rare leaders like Satya Nadella who offered above market severance pay or Eric Yuan of Zoom who took a massive pay cut.

Here’s how Karthik concludes his piece:

‘Taking responsibility’ was perhaps started as a way to add a human element to an otherwise tough piece of communication but I believe it may do more damage to the leader’s persona and the company’s reputation if it is not backed by explaining what the at ‘taking responsibility’ would lead to on the part of the one ‘taking’ it.

b. How Williamson looks at big moments and takes their power away by Alagappan Muthu

I mean how can someone not love Kane Williamson. This insightful take by Alagappan (after that crazy New Zealand-Sri Lanka Christchurch Test) has gems like these:

Williamson is staring at the big screen just like everybody else. If he is anxious, he is hiding it well. The replays are focused on his dive to get to the non-striker’s end. It’s uncomfortably tight.

“He’s got him,” someone says in the commentary box. “He’s safe,” says someone else.

The tension’s rising. Slow motion isn’t helping. And then comes the roar. The Hagley Oval crowd bursts into applause. Several of them are on their feet. They are all toasting a second Test match win for the ages in the space of two weeks. And yet the man who orchestrated them both celebrates with just a small, little smile.

If ever there was a time to get carried away, it was this. And yet all he did was bow his head in sweet relief. Honestly, people open their mail with more excitement than Williamson winning a five-day match off its final ball.

Bonus cricket article: Check out this lovely interview of Virat Kohli by Rahul Dravid, in which both speak about the trait of adapting your natural style to suit the match situation.

📖 1 long-form read of the week

a. The End of Silicon Valley (Bank) by Ben Thompson

Thoughtful article that warns us that this may be an end to the era of trust between business, consumers and govt.

To put it another way, before the events of last week the U.S. benefited from a banking trust dividend: businesses technically should have been worried about money that exceeded the $250,000 insurance limit, but in practice few gave it much concern. This made their operations more efficient, and made money more widely available for banks to lend. Regional banks, meanwhile, got away with lower capital requirements and less regulation, making it easier to extend credit and offer bespoke services. The FDIC, meanwhile, charged relatively low fees of member banks because it was only insuring $250,000 per account, even though its presence made the overall system much safer and more reliable for accounts of all sizes. That trust dividend is now gone, and the costs of replacing trust with explicit rules and regulations will accumulate forevermore.

…

That destabilization and resultant loss of trust, meanwhile, is everywhere around us, from our politics to business to every aspect of media. This increased uncertainty and destabilization has and will continue to drive demands for more government intervention – and, like this weekend, it may not even be wrong! More government, though, means replacing trust with more rules, regulations, and restrictions, which will have a long-term effect on innovation. This, perhaps, is the inevitable outcome of tech having set disruption as its objective function: the ultimate casualty may be the Silicon Valley that once was, not just its bank.

On the Silicon Valley Bank crash, check out this hilarious video by creator Dan Toomey.

That’s all from this week’s edition.

Photo by Ronda Dorsey on Unsplash