The India Cost-of-Capital Story

It was great to be at home for the whole week, which is why the LinkedIn activity was quite high!

Also, the YouTube Channel had gone quiet for a few weeks, but should see some action going forward.

The latest video I released was about the two superpowers that stories have:

And now, on to the newsletter.

Thanks for reading The Story Rules Newsletter! Subscribe for free to receive new posts and support my work.

Welcome to the one hundred and forty-sixth edition of ‘3-2-1 by Story Rules‘.

A newsletter recommending good examples of storytelling across:

- 3 tweets

- 2 articles, and

- 1 long-form content piece

Let’s dive in.

𝕏 3 Tweets of the week

The Godfather of AI saying this means something. While I haven’t tried this for PPTs, I am slowly warming up to Gamma…

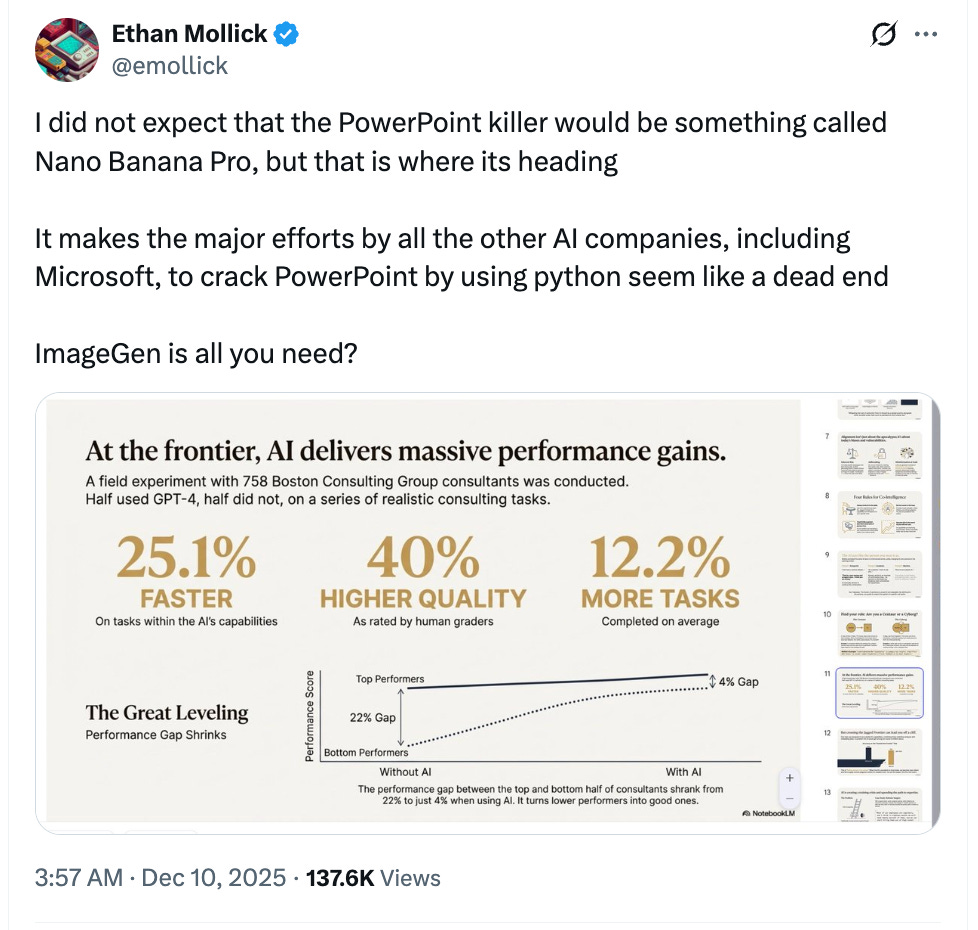

That’s a great analogy. Note that he doesn’t even make the connection with AI!

Superb use of contrast in the writing!

📄 2 Articles of the week

a. ‘Understanding Micromanagement’ by Shreyas Doshi

Is all micromanagement bad? No, says Shreyas Doshi (Product Management expert).

All micromanagement is not created equal.

I am actually a huge fan of micromanagement and I do it quite regularly.

He then defines the 4 types of micromanagement

1) Mistrust-driven

When: you have low trust on your direct report’s ability (skill) or willingness (motivation) to do the task they have been assigned.2) Insecurity-driven

When: you use micromanagement as a tactic to make up for your insecurity in your role as a manager – you micromanage so you can observe how you’d do a much better job (and so you are trying to prove to yourself that you really do deserve the job you are now in).3) Complexity-based

When: the task at hand is extremely complex due to political / interpersonal reasons or technical reasons, and even though your direct report is well suited for the task, it would be impossible for them (or anyone really) to execute on it without a high degree of involvement from you.4) Taste-based

When: the task at hand requires exercising a rare degree of taste, which only few people in the company (or perhaps even in your industry) possess and you are one of those few people.

The last two ones might be needed based on the context.

b. ‘Zomato’s social media content has changed and nobody’s really noticed’ by Deepak Gopalakrishnan

Deepak (a.k.a. Chuck) is one of the sharpest observers of trends in the internet, social media, marketing, music… (phew) and other areas.

In this perceptive piece, he questions the whole basis of social media posting.

He first notices something which most of us (me included) might not have paid attention to:

I find it interesting that Zomato’s social media content has changed and nobody’s really noticed.

I say this because for years, the brand’s irreverence and humour was held as the gold standard of content marketing and winning with Instagram (even LinkedIn!). Brand marketers filling briefs, students writing assignments and even we at The Hard Copy agreed. So earlier this year when the company did a rebrand and did all that black-and-white hustle stuff, it felt like a tiny end of an era.

He then comes to his main insight—social media posting is not as important as it seems:

This bolsters my belief that organic social content is the most overrated form of marketing. Or the one with the worst effort-vs-reward ratio. Social content is difficult to get right, and even if it DOES go right, it has no to little impact on the company’s business – as Zomato’s current approach shows (its stock price is doing fine).

I hadn’t even noticed this!

If you think I’m overthinking this, let’s look at the other Indian brand that kills it on social media – The Whole Truth. Great product, great brand love, great story. A few years back, they posted that they were taking a break from social media because it was a distraction and it was becoming difficult to keep posting high quality content all the time.

Man, should I reduce my own posting…?

Anyway, one takeaway from this post should be: Follow Chuck on LinkedIn and X!

🎧 1 long-form listen of the week

In this fascinating conversation, Myntra and Cult.Fit founder Mukesh Bansal speaks with Axis Bank Chief Economist, Neelkanth Mishra. Some great insights about the importance of capital as a factor of production for a growth economy like India and how we are in pretty good shape with respect to the availability and cost of capital, compared with our past and with other countries.

Mishra talks about the importance of cost of capital for an economy and how India finally seems to have landed in a good place (great use of norm-variance btw):

For the hard problems to get solved you need massive amounts of risk capital because remember for an entrepreneur to function you need large amounts of risk capital because just ideas will not solve the problem.

So when you think about cost of capital and the availability of capital on both fronts there has been substantial progress. So the long-term risk-free rate of capital in India or in any country is the 10-year bond yield of the government. At about 6 and a half% and while many people contest that I think in a year’s time it’ll be below six this is the lowest outside of crisis times…

Look at it from this perspective that there was a time when the 10-year US bond deal was at 2% the Indian bond deal was at 8% so there was a 6% gap. Today the US bond yield is 4% and the Indian is 6.5. So there’s a 2 and a half% gap. I think in a year’s time this could be a 1% point gap. Many large economies I mean in fact if you go back in history, one of the reasons that the Dutch were ahead of Britain in the the the 16th 17th century was that they were known to be big savers and they managed to bring down their cost of capital… because when your cost of capital is low your ability to take risk goes up

Loved the historical reference to the Dutch vs. English cost of capital.

Another good news? India’s public sector banks are in good shape, compared to previous upturns. So debt capital is easier:

… this is the first upcycle where the public sector undertaking banks, the PSU banks are not with impaired balance sheets. So the last two times it happened 2004 to 06 and 2014 to 16 it was primarily because they had lent badly in the previous cycle. They had broken balance sheet they couldn’t (lend)… This time they are so aggressive because on everything that is low risk like salaried mortgages… You must have seen the newspaper reports that PSU banks are gaining share in salary mortgages because they’re the safest asset that you can find and they’re pricing out all the rest. I am aware of PSU banks lending to other PSUs one-year loans at 5.46%. So it’s absolutely remarkable how the cost of debt capital has come down.

Fascinating stuff. Again great use of norm-variance.

He then moves to the equity side of the equation. Here too the story is rosy, led by growing SIPs in mutual funds:

So just to give you the numbers today there is $3.5 billion of SIP money coming into mutual fund equity mutual funds every month which is $42 billion a year which is give or take 1% of India’s GDP. Yeah and that’s probably fair to say growing at least 10% and only it is growing faster than that… And in addition there is EPFO. So the provident fund organization which is now contributing I think 7 to 8 billion a year in equity. There is also insurance. As insurance penetration grows a certain amount of the premiums are to be allocated into equities.

So, SIP plus EPFO plus insurance plus there is also some discretionary investing in equities right so the so if you put that together let’s say on a sustained basis 70 – 80 B$… so that’s a massive amount of risk capital that is being generated.

Mishra credits demonetisation and the “Mutual Funds Sahi hai” campaign for some of the growth:

… till the time that this (equity capital inflows) is coming in, it is like it’s like you know sunlight and fertilizer and a fertile soil and a whole new ecosystem is emerging and this whole thing has just emerged last even maybe max 10 years right this is post demonetization. So during demonetization as a lot of black money was forced into the system, many of these savers who were holding cash had to find better ways to deploy it. And so that’s where The AMFI (Association of Mutual Funds of India) launched this “Mutual fund sahi hai” scheme and that did some education and the SIPs have actually spread through word of mouth

Listen to the entire conversation for more interesting insights—on improving regulations, GST simplification, and the reforms that are still needed for growth.

That’s all from this week’s edition.

Photo by Diana Polekhina on Unsplash