The story of India’s biggest startup exit

Welcome to the twenty-first edition of ‘3-2-1 by Story Rules‘.

A newsletter recommending good examples of storytelling across:

- 3 tweets

- 2 articles, and

- 1 long-form content piece

Let’s dive in.

🐦 3 Tweets of the week

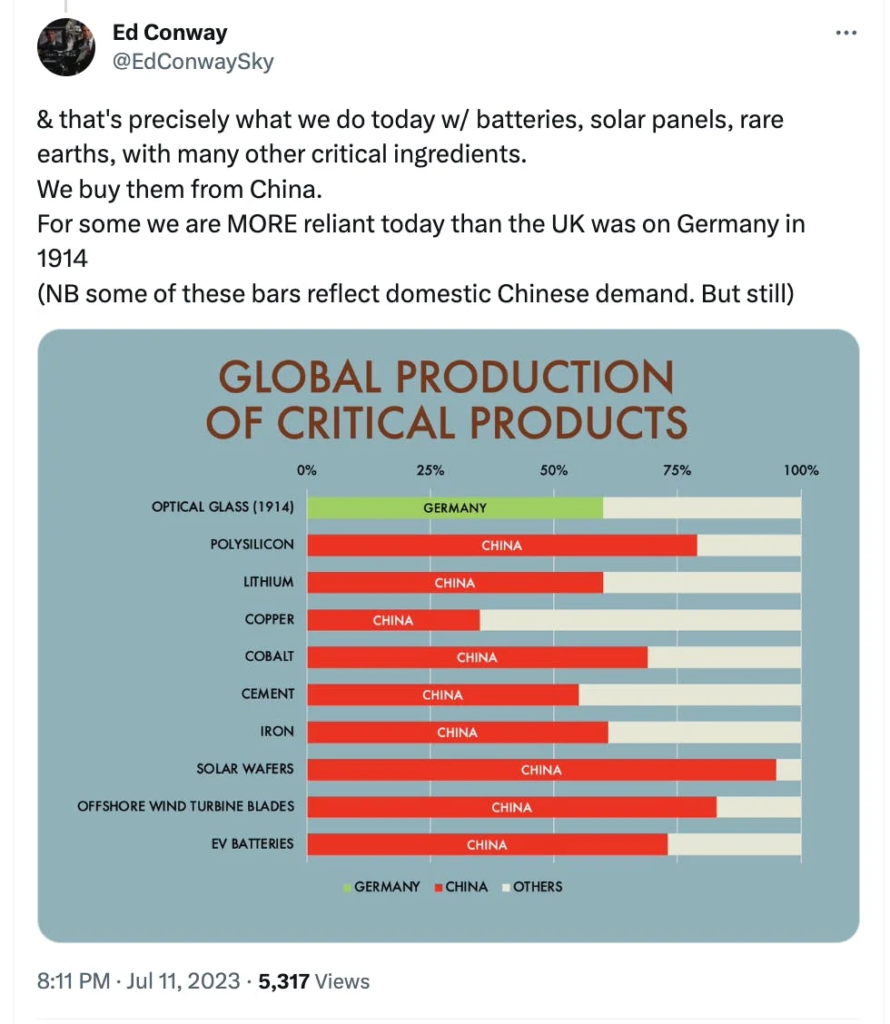

This is a worrying graph given how strained China’s relations are getting with the rest of the world.

A stunning thread with pictures to die for. Check out the images of Kedarnath and Chausanth Yogini…

Good to see the steady improvement in delivery of basics – even if there may be a long way to go in terms of reliability and quality.

📄 2 Articles of the week

a. ‘Metaphors for AI, and why I don’t like them’ By Boaz Barak

We love to express the novel in terms of the familiar. AI is no different and writers have tried several analogies to explain it.

In this article, Boaz Barak, a Computer Science Professor at Harvard cautions us against this tendency:

…we do not understand AI enough to make confident predictions or analogs, so we should take any metaphor with a grain of salt. Hence I am also suspicious of articles saying “AI is going to certainly cause Y because it is just like X.”

In the article, he considers various metaphors and explains where the likeness breaks down.

Here’s his concluding para:

Metaphors can be useful ways to build intuitions for them, but we should be wary of any article of the form “AI is like X”, especially one aimed at the general public. Probably the best we can say is that “This aspect of AI is like X” or “These types of AI systems, used in this way, are like X”. As mentioned, some of the people that coined these metaphors are well aware of these limitations, but metaphors have a way of being over-interpreted.

b. 8 Cs (skills) that you should start inculcating in your classrooms by Mahesh Shenoy

Mahesh, a Senior Content Manager at Khan Academy, creates some great visual content on how to teach better.

This post has some simple yet powerful principles (inspired by Sir Ken Robinson’s book) to keep in mind to make your classroom teaching more effective. A great resource for teachers!

📖 1 long-form listen of the week

a. ‘India’s Largest Exit’ – Balaji S with Binny Bansal on the Network State podcast

Two youngsters start an online bookstore in 2007 and build it into one of the world’s largest e-commerce companies, selling the business to Walmart at a massive $16B valuation in 2018.

In this fascinating conversation, Binny Bansal, one of the co-founders of Flipkart shares the journey of this epoch-defining company.

One of the ideas that spend a lot of time on is how Flipkart (and its investors) actually invested a ton of money to increase trust in the entire Indian ecosystem. Their mantra can be stated as: To earn trust you have to invest it first.

Binny: So we had to come up with this thing called 30-day no-questions-asked return policy, which in the US is probably just par for the course. But in India, it was like the innovation of the decade. Because as I said, in India, (the policy of) retail was ‘Once sold, no return’, right? So to go from ‘Once sold no return’ to 30-day, no-questions-asked returns was like a huge, huge pivot, right?

Balaji: You get out of the low trust disequilibrium into the higher trust equilibrium.

And this one:

Binny: So we did these three things…

Balaji: (Invest in building a) Brand, Cash on delivery and Returns, all of which are like trust-building

Binny: Exactly. Yeah. All of these were really trust-building things

Balaji brings in a global perspective – especially about how the US and China markets are similar and different compared to India. (He does interrupt Binny’s flow quite a bit though, but Binny usually gets back on track!).

That’s all from this week’s edition.