An analogy about Tech Regulation

This week’s articles are two thought provoking interviews – one of Benedict Evans (tech thought-leader) and the other of Anshuman Bapna (Founder, Terra.do) by Sajith Pai.

📄 Article/s of the week

a. Tech is Becoming a Regulated Industry – interview with Benedict Evans

Ben Evans is one of the foremost thought-leaders in the world of tech. In this fascinating conversation, he talks about the present and future of tech. More crucially, he applies some much needed historical context to put current events in perspective.

Here’s an insightful analogy he uses to describe the recent wave of regulatory action on tech leaders:

Interviewer: Questions about the regulation of corporations with dominant platforms such as Apple, Amazon, Google and Facebook are a constant source of public controversy. What do you think about this topic?

Ben: Every big, complex, important industry has industry-specific regulation, from railways to food to aircraft to cars. Tech is becoming a regulated industry as well. The metaphor I would use is regulating cars. We don’t actually regulate ‘cars’ – that’s about fifty different things, and most of them are quite complicated. For instance, what do we do about teenagers getting drunk and driving too fast? What about parking, congestion charges and questions like “should we pedestrianize Zurich?” What about seatbelts and emissions? What do we think about the tax code and encouraging innovation? Or is GM bullying their suppliers? These are all complicated questions, and we spent 75 years thinking about them. Now, we’re trying to do tech in like five years.

Hat-tip: Sajith Pai on Twitter

b. PMF Convo #2 – Anshuman Bapna, Terra.do by Sajith Pai

When Sajith Pai says the following about a conversation…

…you pay attention

The interview is with Anshuman Bapna (ex-MyGola and MakeMyTrip and founder of Terra.do) about the concept of Product-Market Fit.

While it is intended for startups, the concepts discussed are thought-provoking for all leaders.

Here are three useful insights:

1. Don’t try to innovate on more than one “axis” at a time

…one of the things that I’ve realized across the four different startups, companies and so on I have been at, is that you can innovate on at most one axis at a time. If, as a startup, if you try to do more than one axis, then you’re, then you wouldn’t have enough runway to be able to crack both of them. So, we were already innovating massively on the product side. We ended up getting a US patent on text mining. We ended up building this algorithm that could automatically read any article or blog and convert it into an itinerary, which was not done before and so on. We did this beautiful interface; we won a lot of awards for that. We did a ton of product innovation, but you’re also trying to do a business model innovation at the same time, which is that somehow all this money that goes into travel will start flowing in a slightly different way.

2. Solve for the biggest risk, not the risk you are best equipped to solve

Sajith: Did you feel that in hindsight, if you were to go back now with all the wisdom that you have, how would you kind of redo it? What would be the change?

Anshuman: I think the one thing that I have realised, and I’ve seen this now as an angel investor also is that entrepreneurs sometimes make the mistake of solving not the biggest risk, but the risk that is most solvable by them first, right? So, in my case, the biggest risk was actually the business model, which is how will you make enough money to actually make this all work? But what I really knew was how to build a great product and make it highly, highly scalable

This quote hit me personally – in our mobile audio guide startup, we weren’t as focused on solving for the biggest risk: will people be willing to pay for audio content on historical monuments. Instead I was at least focused on solving for – can we make the experience engaging and memorable… which turned out to be the easier problem.

3. Pictures pack in more insight than words – search with Google Images

…one mode of learning which really works well for me. And the way that works really well is to actually just be power users of Google. And one of my hacks is to start at images.google.com not google.com. Because it turns out that when people are trying to be really really pithy about their deepest insights, they will try to capture that in an image or a graph or a framework or something like that. So I start there. There will be five different images and you can over a period of time, get a sense of the sector. So that’s one way of learning

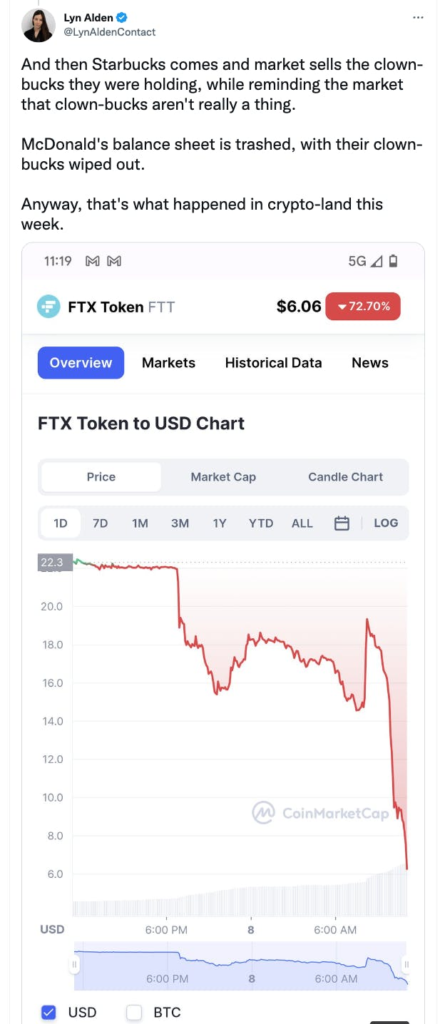

c. Why FTX failed by Finshots

This is a superb explainer of the FTX saga by Finshots. It is not easy to make something to complex so easy to understand.

🎧 Podcast episode/s of the week

a. The Halloween Poisoner by Cautionary Tales with Tim Harford

I’d changed podcast players earlier this year and had forgotten to subscribe to this gem of a podcast. Recently I rediscovered it and have a ton of catching up to do.

So I started with this episode on spooky Halloween stories – not about ghosts and vampires, but about real life horrors. Specifically, unscrupulous strangers who are accused of handing over poisoned or adulterated candy to kids who go out trick-or-treating. The question is, are they guilty?

Tim’s fabulous storytelling skills are on full display as he narrates bone-chilling incidents of harm befalling young innocent children… and then reveals the surprising twist underlying these stories.

🐦 Tweet/s of the week

A useful analogy that tries to explain what was happening in the FTX collapse.

Supply creates its own demand

Check out this fun animated video of 500+ years of European history!

This is a great set of techniques by Tim Urban to raise your empathy while interacting with strangers on Twitter

💬 Quote of the week

“The word risk means different things to different people. Some people say risk. Some people say opportunity.”

– Changpeng Zhao (CZ), founder of Binance quoted here

📹 Video/s of the week

a. Why 70% of Spain is Empty (15:31)

A superb video on the geography (and history) of Spain that explains why so much of the country is so less populated. I loved the use of norms and how they made the numbers (and areas) relatable.

b. The Earth is Dying by Foil Arms and Hog (2:36)

The masters of ‘anthropomorphism’ are back with another brilliant one. The Earth is hospitalised and seriously ill. The doctor knows what is the ailment. But the question is – will he do something about it?

That’s it folks: my recommended reads, listens and views for the week.

Take care and stay safe.

Photo by cottonbro studio: https://www.pexels.com/photo/black-vinyl-record-on-white-table-3944104/