Life of a VC – as shared by Sajith Pai

Welcome to the thirty-sixth edition of ‘3-2-1 by Story Rules‘.

A newsletter recommending good examples of storytelling across:

- 3 tweets

- 2 articles, and

- 1 long-form content piece

Let’s dive in.

🐦 3 Tweets of the week

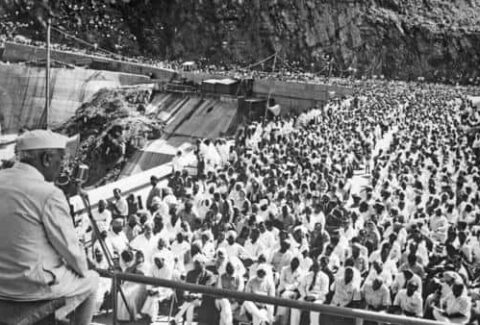

This is such a stunning visual. The impact of those two mighty rivers!

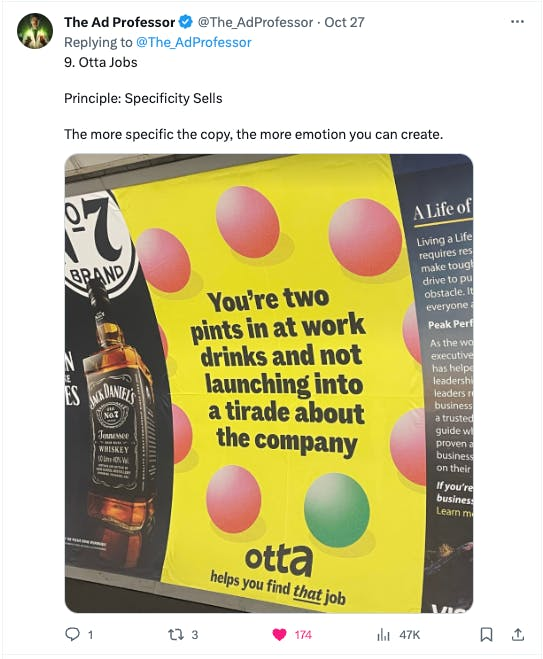

Tell me you love your job without telling me you love your job!

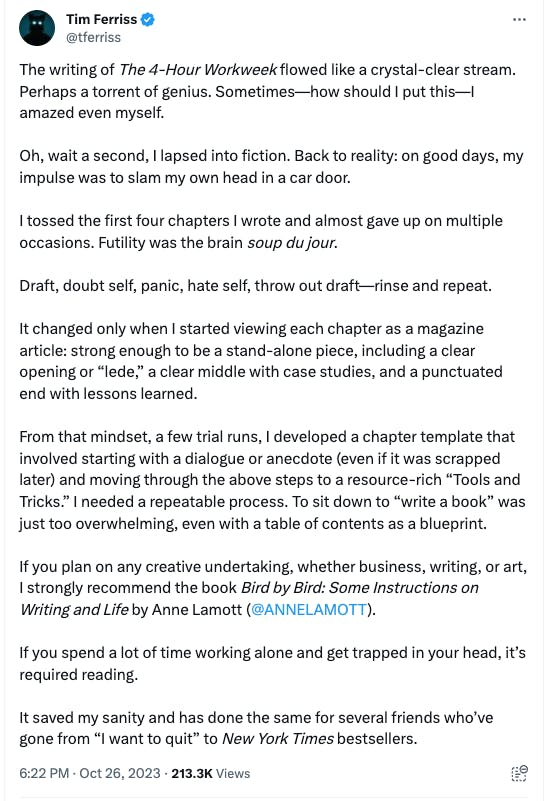

Tim Ferriss with some encouraging advice on writing.

📄 2 Articles of the week

a. India’s Sell-Side Researchers Should Say What They Mean

Bloomberg columnist Andy Mukherjee displays some sharp wit in this piece where he implores equity researchers to tell it as they see it and not sugarcoat bad news.

I chuckled at this opening para:

The sell-side research community in Mumbai has to be the world’s most polite. Rare is the analyst who will use an unkind word if a more painless and pointless alternative can be found — or invented. But tactfulness extracted a price six years ago, and it may come to bite again. Last time, trouble erupted in banking. This time, it is brewing in outsourcing.

This part is priceless:

As George Orwell said in Politics and the English Language, the decline of language ultimately has political and economic causes. Stockbrokers in India use empty phrases as a tribute to corporate power. So, sales and profit don’t decline for large Indian outsourcing companies, they “degrow.” A workforce doesn’t shrink; the addition of employees turns negative. The motto is simple: Present the good.

‘Addition of employees turns negative’, hehe.

b. ‘Relax, Pakistan have got this’ by Osman Samiuddin

This is not schadenfreude on Pakistan’s defeat to Afghanistan in the Cricket World Cup, but appreciation for a gem written by Osman Samiuddin on ESPNCricinfo. This was a game where most bets would have favoured Pakistan before the match.

And even if they lost, it was expected to be due to the individual brilliance of one or two mercurial Afghan talents – not due to a calm, collected and professional performance by the whole team.

But Afghanistan has grown leaps and bounds this World Cup – and Samiuddin does a brilliant job of translating the undying hope and angst of the Pakistan cricket fan into biting dark humour.

Hasan’s back and wait did you see that? You saw, right? I’m not hallucinating. Ball did something. Shaped in. A hint. Reverse? Another wicket. Still 90-odd to get. Ah, so this is how it’s going to play out. It’s taken a bit of time to get here but this is it. Reverse to take them home and we’ll dress up the collapse as Haal. Two overs, only four runs, one maiden. Even Athers is talking about it on air, willing it into reality. Pakistan are going to pull a rabbit out and you better get your ’92 on.

I love how he ends with a brutal twist of the knife in the last line (which is also a neat callback). You have to read it to enjoy it.

📄 1 long-form read of the week

a. Reflections on Completing Five Years in Venture Capital

When Sajith Pai writes a long-form piece, you ‘DEAR’ (Drop Everything And Read).

The essay is perhaps the most comprehensive (and insightful) window into the life of an early-stage VC. If you’re considering a job in the space (or are working with a VC) you’ll be much better informed by the end of it.

I loved this analogy of a ‘postcard from the future’:

In one day your discussions can range from a morning coffee with founders of a skilling startup, to afternoon lunch with someone building a marketing copilot, to a late evening encounter with a healthcare founder. I like to think of these pitches, each with a distinct vision of the future, as ‘postcards from the future’. They can’t all be right, and not all will succeed, but the ability to influence some of these and help support in creating the future is a great reward.

This one surprised me (emphasis mine):

Two, we have seen misreporting of numbers as founders tried to keep the story going even as their revenue dipped. There have been a bunch of these incidents, though the one that disturbed me the most was Mojocare, primarily because one of the cofounders was an ex-VC, and he was also backed by his previous firm. Something about the fact that he would have been highly trusted by his ex-colleagues and some of them may even have blindly backed him, and yet he chose to indulge in fraud, was disturbing. Now, for those of you who ask but how come VCs didn’t know that as they are on the board etc., and don’t you double click on the numbers etc., the surprising truth is that in the venture context, a founder who really wishes to misrepresent numbers can get away with it if they so wish.

Insightful reference to the Uncertainty Principle:

It is a bit like the Heisenberg Uncertainty Principle applied to human relationships – the act of verifying the numbers shared by the founder creates mistrust in the relationship. Because you are typically one of many VCs aboard the company, you will never want to appear excessively questioning because you feel the founder will then start favouring other investors.

Nice framing to describe the ‘repeat founder’ market:

The repeat founder market, where the founder has far more power – more VCs chasing him than the reverse resulting in his or her being able to command higher deal sizes and valuations – is effectively a sell-side market as the VCs need to sell themselves to the founder. Alex Bangash, who runs Transpose, a fund of funds platform, describes this upper tier of venture as an ‘access class’, and describes this as the only investment class where the asset picks the manager.

Being a VC is not an easy life! (emphasis mine):

The calls and pings can often be overwhelming – everyone it seems wants to talk to a VC, be it potential founders who want to bounce off their latest ideas, or your existing portfolio founder needing an intro, to a journalist who wants your perspective, and so on and so. This leads to what Mamoon Hamid of Kleiner shared in a podcast that Leo Polovets captured succinctly – “every meeting is energizing, but the aggregate of all meetings is draining”.

A mitigating factor is that many of these pings (calls, WhatsApp messages) are brief, or demand brief interventions. But they are continuous. At 10pm, there are always a dozen unread WhatsApp messages which need to be responded to. Correction. At any point there are always a dozen unread WhatsApp messages that need to be responded to. And you are always responding (at least I am), in meetings, during dinner with the family, while reading etc. Sometimes I fear that I have lost my capacity for deep concentration as a result of all of this continuous WhatsApp use. Recently I heard about a VC at a leading fund who doesn’t have WhatsApp installed on his phone. Life goals!

That’s all from this week’s edition.

Photo by Joshua Mayo on Unsplash